Retirement Planning

Planning for retirement may be the number one reason that people invest. As improvements in medical science have extended human life spans, the need for retirement planning has become paramount.

At StyleTrack we call this Financial Freedom. We will work with you to determine the answers to important questions such as:

- How much do you need to reach your Financial Freedom?

- What effect will inflation have on your retirement projections?

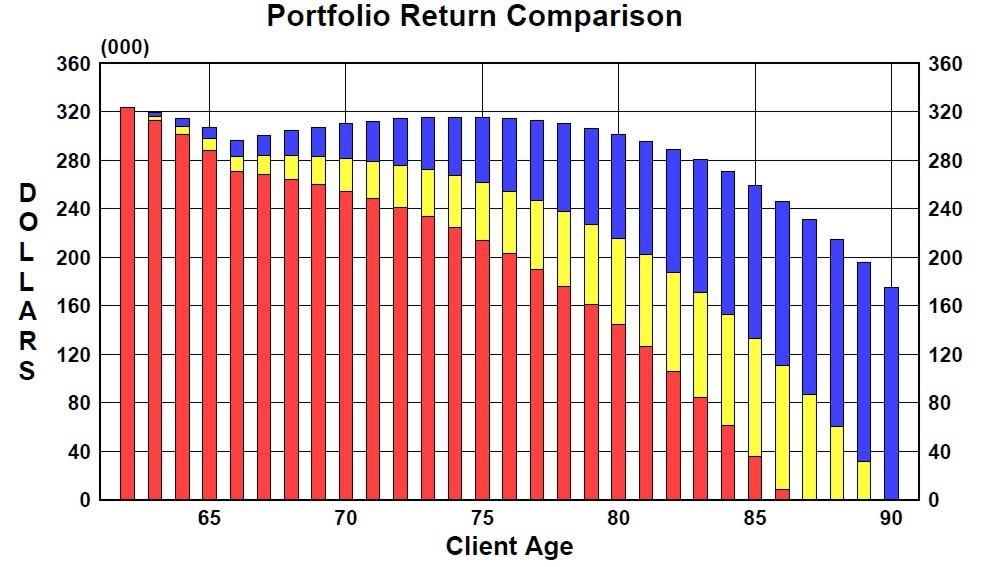

- How long will your money last in retirement?

- What can be done if there is any forecasted shortfall?

- How does a job change affect your projected outlook?

- What is the typical life expectancy in your family history?

- Do you hope to retire early?

Another factor we will consider is the type of account(s) that should be used to achieve your goals in the best fashion. Do you have IRA’s? Do you qualify for a Roth IRA? If not, can you do a Backdoor Roth IRA? Do you need the protection of a trust account? All of this becomes part of the overall retirement planning process.

Retirement forecasts are a dynamic target and we strive to update them at least annually.

Working together as a team we will sit down together and evaluating portfolio changes, as well as any changes in your personal circumstances so that we can stay on target to reach your retirement dreams.